Why More Filipinos Are Turning to Stocks, Crypto, and Real Estate

Investments That Thrive in 2025: Why More Filipinos Are Turning to Stocks, Crypto, and Real Estate

How inflation, digital access, and shifting mindsets are reshaping wealth-building in the Philippines

In 2025, a growing number of Filipinos are rethinking how—and where—they grow their money. Traditional savings accounts, while still essential for safety and liquidity, no longer feel sufficient for long-term wealth building. Inflation has eroded purchasing power, wages have struggled to keep pace with rising costs, and economic uncertainty has become the norm rather than the exception.

As a result, stocks, cryptocurrency, and real estate have emerged as increasingly popular alternative investment tools for Filipinos seeking growth, diversification, and financial resilience. These assets differ in risk, complexity, and time horizon—but together, they reflect a broader shift in how Filipinos approach investing in 2025.

This article explores which investments are thriving in 2025, why more Filipinos are embracing them, and what this means for the future of wealth-building in the Philippines.

Why Filipinos Are Exploring Alternative Investments in 2025

1. Inflation changed how Filipinos think about money

Years of elevated prices for food, housing, transport, and utilities have made one reality clear: money that simply sits still loses value. Even conservative savers now recognize that interest from traditional savings accounts often fails to keep up with inflation.

This realization has pushed many Filipinos to look beyond deposits and toward assets that can outpace inflation over time.

2. Digital platforms lowered the barriers to investing

In the past, investing required:

-

- Large starting capital

-

- In-person brokerage visits

-

- Complex paperwork

In 2025, investing is increasingly mobile-first. Online brokerages, digital wallets, and investment apps allow Filipinos to start with smaller amounts, learn as they go, and track performance in real time.

Accessibility—not just higher returns—has been a major driver of adoption.

3. A younger, more financially curious population

Millennials and Gen Z Filipinos are:

-

- Entering peak earning years,

-

- More comfortable with technology, and

-

- More exposed to global financial content via social media.

Instead of relying solely on employer pensions or savings accounts, younger investors are actively building portfolios, often mixing traditional and alternative assets.

Stocks in 2025: Still the Backbone of Long-Term Wealth

Despite market volatility, stocks remain a cornerstone of long-term investing in 2025.

Why stocks continue to thrive

Equities represent ownership in businesses. Over long periods, companies grow alongside the economy—making stocks one of the most reliable wealth-building tools historically.

In the Philippines, many investors focus on companies listed on the Philippine Stock Exchange, particularly:

-

- blue-chip firms with stable earnings,

-

- dividend-paying stocks that generate passive income,

-

- companies benefiting from domestic consumption and infrastructure spending.

What changed in 2025?

Filipino investors are no longer chasing only short-term gains. Many are shifting toward:

-

- Dividend investing for steady cash flow,

-

- Peso-cost averaging to manage volatility,

-

- Long-term holding strategies rather than speculative trading.

This more disciplined approach reflects growing financial literacy and awareness of risk

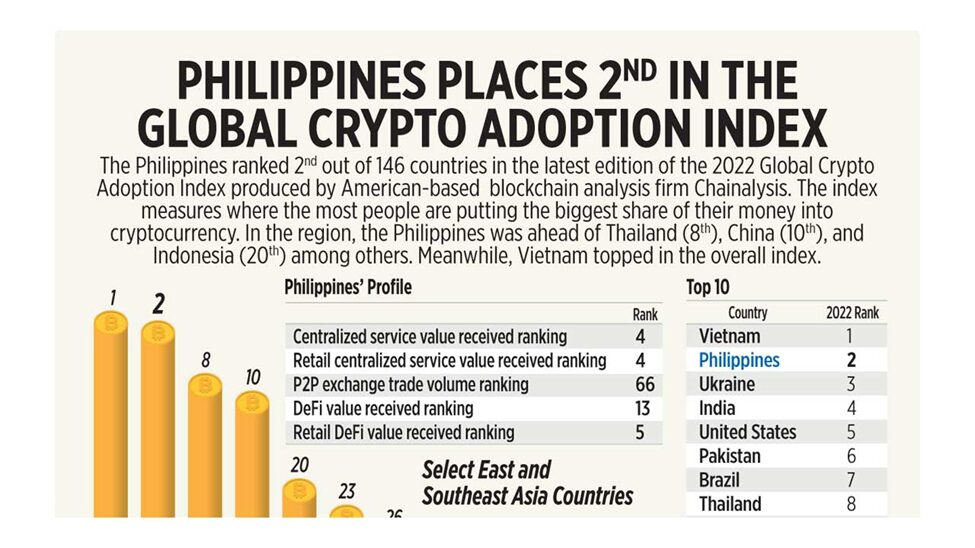

Cryptocurrency in 2025: From Speculation to Strategic Allocation

Cryptocurrency remains one of the most debated investment classes—but in 2025, its role has matured.

Why Filipinos are still interested in crypto

Assets like Bitcoin and Ethereum are increasingly viewed as:

-

- alternative stores of value,

-

- hedges against currency depreciation,

-

- gateways to blockchain-based financial systems.

For Filipinos with exposure to global markets or overseas income, crypto offers borderless access to digital assets.

A more cautious, informed crypto investor

Unlike earlier boom cycles driven by hype, 2025 investors are:

-

- allocating smaller portions of their portfolio to crypto,

-

- focusing on established networks rather than obscure tokens,

-

- prioritizing security, custody, and regulation.

Crypto is no longer an “all-or-nothing” bet—it’s a calculated risk within a diversified portfolio.

Unlike earlier boom cycles driven by hype, 2025 investors are:

-

- allocating smaller portions of their portfolio to crypto,

-

- focusing on established networks rather than obscure tokens,

-

- prioritizing security, custody, and regulation.

Crypto is no longer an “all-or-nothing” bet—it’s a calculated risk within a diversified portfolio.

Why crypto resonates in the Philippine context

-

- High smartphone and digital wallet adoption

-

- Large overseas Filipino worker (OFW) population familiar with cross-border finance

-

- Distrust of purely centralized systems among younger investors

While volatility remains high, crypto continues to attract Filipinos willing to tolerate risk for potential long-term upside.

Real estate has long been a favored asset in the Philippines—and in 2025, it remains a key pillar of wealth-building.

Why property continues to attract investors

Real estate offers a combination of:

-

- tangible value,

-

- potential rental income,

-

- long-term appreciation,

-

- protection against inflation.

For many Filipinos, property represents security and legacy, not just returns.

What’s different in 2025

Today’s real estate investors are more strategic. Instead of buying purely for ownership, many are focused on:

-

- Rental yield vs purchase price,

-

- Locations near transport hubs or economic zones,

-

- Smaller, more affordable units with steady demand.

Some investors also explore financing options via institutions like the

Pag-IBIG Fund, making property more accessible to salaried workers.

Why real estate feels ‘safer‘

Compared to stocks and crypto, property prices:

-

- Moves more slowly.

-

- Felt more predictable.

-

- And are less influenced by daily market sentiment.

This makes real estate especially appealing to conservative or mid-life investors balancing growth with stability.

Why Filipinos Are Combining Stocks, Crypto, and Real Estate

Rather than choosing just one asset class, many Filipinos in 2025 are diversifying across all three.

The diversification mindset:

-

- Stocks provide growth and dividends;

-

- Crypto offers high-risk, high-upside exposure;

-

- Real estate delivers stability and income.

Together, they reduce reliance on any single source of returns.

Learning from Past Crises

Filipinos who have lived through the pandemic, sharp inflation spikes, and repeated job disruptions have learned a lasting lesson: relying on a single income or asset is risky. Investing today is less about chasing quick gains and more about building resilience—so families can withstand economic shocks and uncertainty.

Risks Filipinos Must Understand in 2025

While these investments can deliver strong returns, none are risk-free.

-

- Stocks are subject to market volatility, company-specific setbacks, and emotional decision-making during downturns.

-

- Crypto carries extreme price swings, regulatory uncertainty, and security or custody risks.

-

- Real estate involves illiquidity, high upfront costs, and sensitivity to interest-rate movements.

Successful investors are those who align their investment choices with their risk tolerance and time horizon—not short-term market noise.

What This Shift Says About Filipino Financial Behavior

The rise of alternative investments reflects a deeper transformation:

-

- Filipinos are becoming more financially proactive;

-

- Money conversations are more open and data-driven;

-

- Wealth-building is seen as a long-term process, not luck.

This shift is crucial in a world where traditional safety nets feel less certain.

Investing in 2025 Is About Strategy, Not Trends

Stocks, crypto, and real estate are thriving in 2025 not because they are fashionable—but because they address real financial needs in an uncertain economy.

For Filipinos, the key lesson is clear:

The best investment is one you understand, can hold through volatility, and aligns with your long-term goals.

As access improves and financial literacy deepens, more Filipinos are stepping into the role of intentional investors—building wealth patiently, thoughtfully, and with eyes wide open.