Philippines’ first app to provide free official credit reports and loan recommendations instantly from trusted lenders.

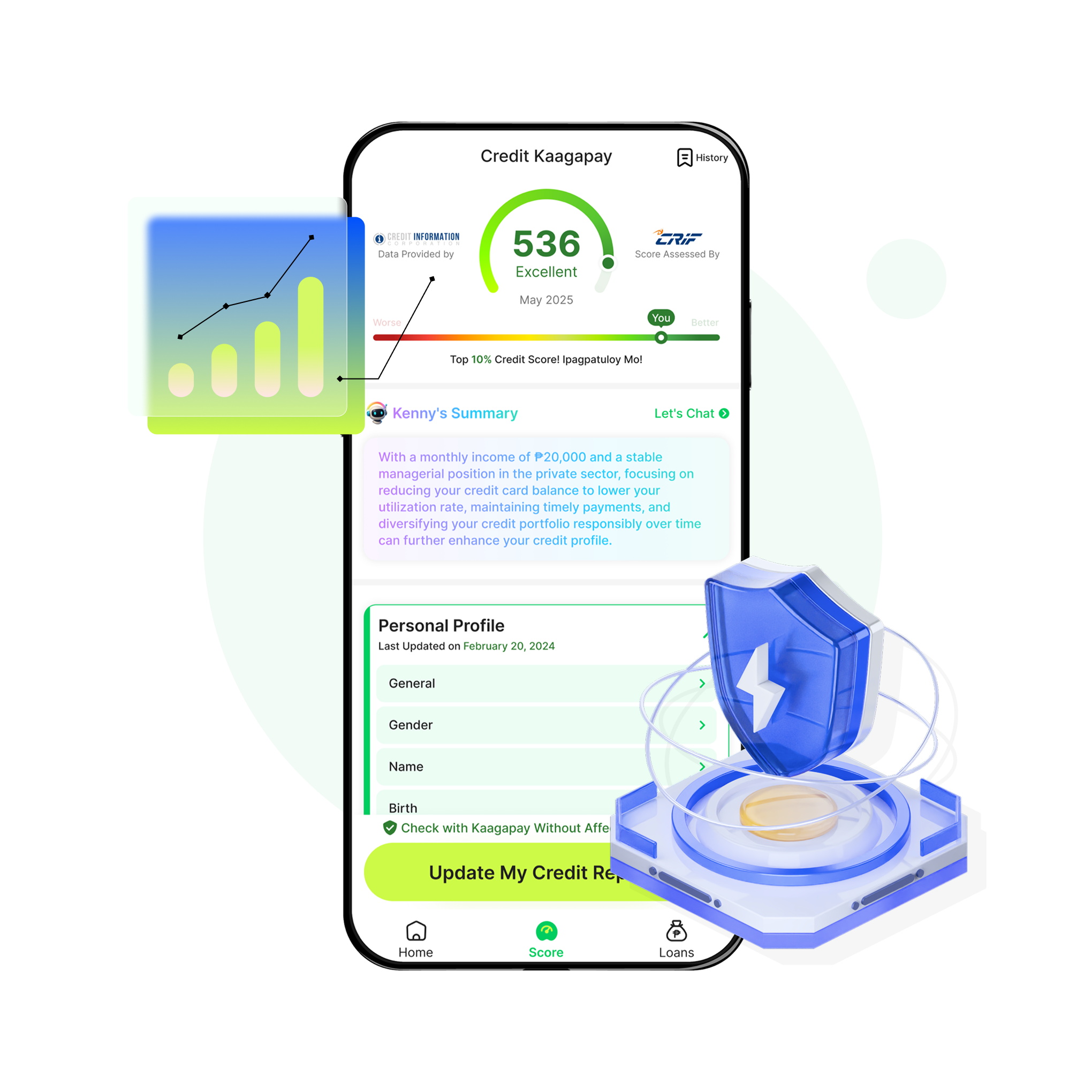

Access your official CIC credit reports anytime, at no cost.

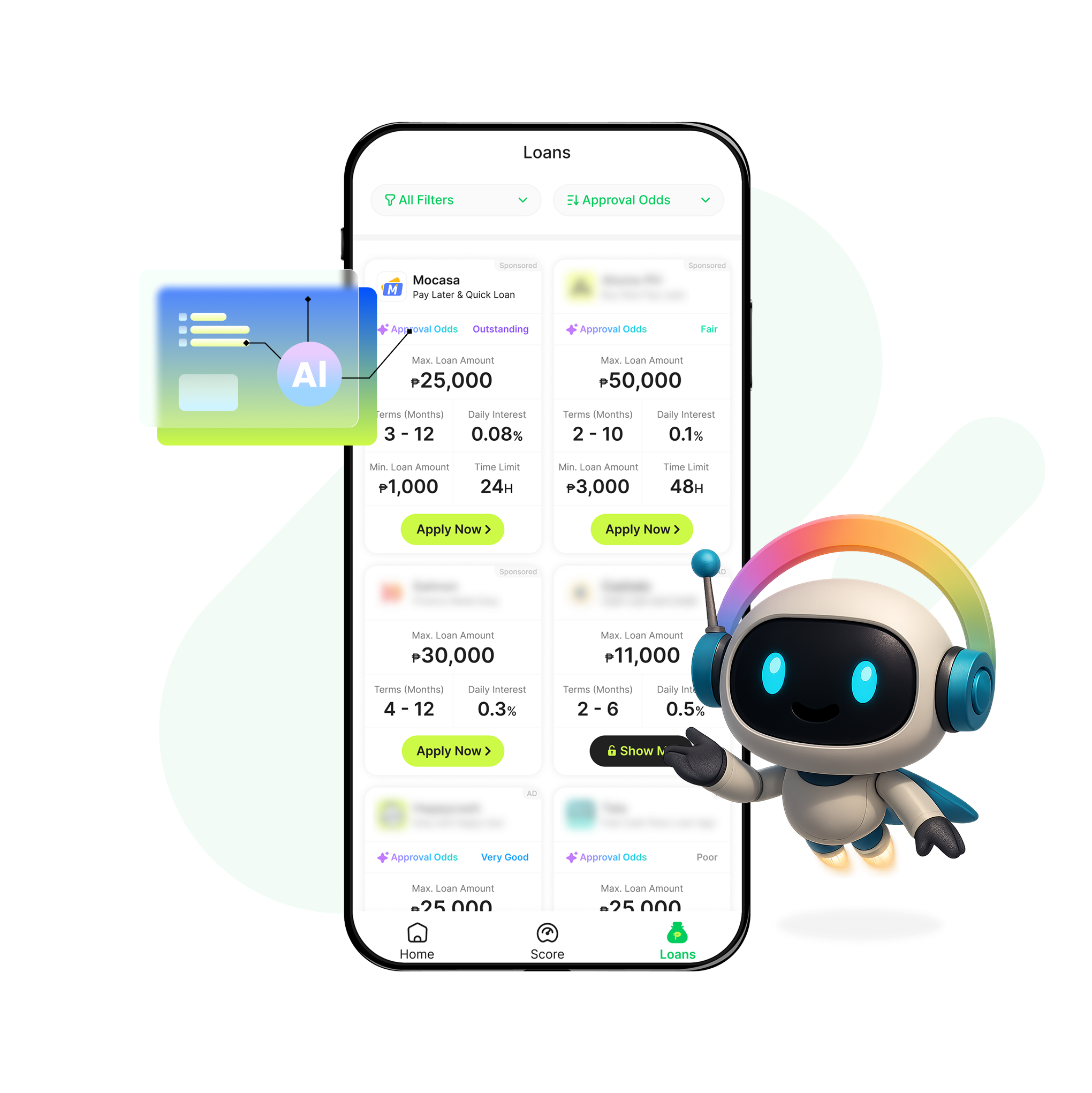

Find and compare thousands of low-interest loans and cards in one place.

Get personalized tips and credit-builder tools to improve your score.

Credit Kaagapay® is the Philippines’ first free credit report app and AI-driven loan finder built for Filipinos. We partner with the Credit Information Corporation (CIC) to provide you an up-to-date, official credit score. With this knowledge, you can improve your financial health and secure loans at lower interest.

Quick KYC with mobile number.

Access your CIC credit report instantly.

AI suggests best loan options for you.

Follow our tips and use credit-builder tools for better chances.

How Credit Kaagapay helps solve your financial challenges.

Many borrowers don’t realize that low credit scores or unpaid debts can cause rejections. Credit Kaagapay solves this by giving you a free official credit report that shows exactly where your credit stands.

Our AI analyzes your report and highlights the main reasons for any loan denial (e.g. a low score or high debt), so you understand what to fix. By knowing the factors behind the rejection, you can address issues and try again with confidence.

We use AI to scan thousands of loan and credit card offers and match you with those that fit your profile. Our platform compares interest rates and fees across all partners, so you can easily see which loan gives you the lowest cost.

Instead of searching lender by lender, let Credit Kaagapay do the hard work: you get a shortlist of tailored low-rate options in seconds.

A high credit score opens doors to better loan terms. We help you raise that score: get personalized tips (like lowering your credit utilization or paying bills on time) and consider our credit-builder programs.

For example, secured credit cards or savings-backed “credit-builder” loans can quickly establish positive history. Credit Kaagapay even links you to partners offering such services, so you can build credit and increase approval odds.

Join our network and grow your business with Credit Kaagapay

For banks, non-bank lenders, insurance companies, and more

For publishers, fintech apps, credit counselors, and influencers

Credit Kaagapay® is operated by Kaagapay Platform Inc, a regulated internet company in the Philippines.

Our blogs and finance articles offer practical tips to help you improve your finances and make smarter money decisions.

The Philippines’ first free credit report app

Credit Kaagapay® (“kaagapay” means “ally” in Tagalog) is the Philippines’ first free credit report app, pioneering access to credit information with our AI-powered platform. We were founded with a mission to democratize credit access and promote true financial inclusion across all segments of society.

Our advanced machine learning algorithms work with the national CIC to analyze your credit data in real-time. We go beyond basic credit scoring by using artificial intelligence to detect patterns, identify opportunities, and provide personalized recommendations that traditional systems miss. Our platform makes complex financial information accessible to everyone, especially the underserved.

Financial inclusion is at our core. We believe that everyone deserves access to fair credit, regardless of their background or location. As the first app in the Philippines to offer free credit reports, Credit Kaagapay® bridges the gap between borrowers and lenders to help previously excluded Filipinos join the formal financial system. Our mission is to help you unlock better loans and improve your credit, ultimately leading to lower interest rates, greater approval odds, and a more equitable financial future for all.

Get your first CIC credit report for free! Get to know your credit status and get loans smarter with our help.